Finding joy in unusual places

Looking for some alternative and unusual ways to de-stress, relax and find a spot of joy?

14 March 2024

Read more

Rebalancing – what it is, why it matters

Whether you work with a financial adviser or manage your own portfolio of investments, it’s important to understand the role of rebalancing and regularly review your asset allocation.

14 March 2024

Read more

Bigger bonus for working pensioners is now permanent

Senior Australians can earn more from employment to address cost-of-living pressures without impacting their pension payments.

14 March 2024

Read more

The board game renaissance

The board game market is growing and growing, and there are some compelling reasons to play that go way beyond nostalgia.

04 March 2024

Read more

Financial wellbeing and rising cost of living

As inflation soars to the highest rates in two decades, older Australians are becoming increasingly concerned about their capacity to manage the rising cost of liveing.

04 March 2024

Read more

Pay down mortgage or boost super – which is best?

You might be wondering what to do with your cashflow given the recent rise in home loan interest rates.

04 March 2024

Read more

Beyond Bricks - companies powering organisational design to create a sustainable competitive advantage

The history of societal progress is often told as the history of technological change.

30 August 2023

Read more

Keys to long-term wealth creation

Understand the relationship between valuation, volatility, and wealth creation risk.

30 August 2023

Read more

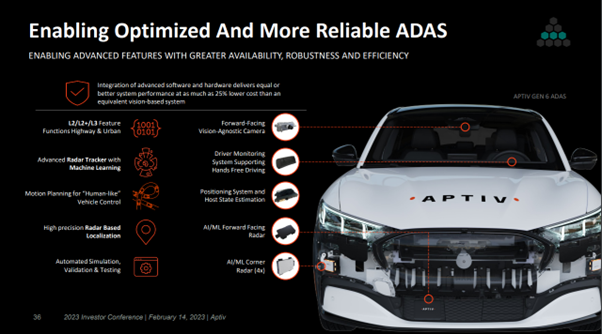

Power-hungry AI a watch-out for equity investors

In all the investor excitement about AI equities, investors may be missing a crucial factor. Pendal equities analyst ELISE MCKAY explains.

30 August 2023

Read more

Minimum pension payments return to normal (no more 50% reduction)

Retirees with account-based pensions are required to take the standard minimum pension amount each year from their account.

30 August 2023

Read more

Greater super contribution opportunities from 1 July 2023

If you are looking to increase your super, and are aged 75 or under, then a good way is through making non-concessional contributions.

30 August 2023

Read more

Want to fight climate change? New research details which actions have the most impact

The most common actions Australians are taking to reduce their carbon footprint include recycling paper, plastics and glass and drying their clothes on a line or rack instead of using a dryer

25 May 2023

Read more

When Markets Twist and Turn, Flex Your Fixed Income

Investors are grappling with a number of market and economic challenges at present, including high inflation, geopolitical risks, banking sector worries, and heightened uncertainty over the path of monetary policy.

25 May 2023

Read more

Government’s proposed changes to the taxation of super

The Government has announced its intention to change the tax concessions for certain super accounts if you have a total super balance of more than $3 million.

25 May 2023

Read more

Global approaches to aged care

Aged care has been a hot topic in Australia over recent years – and with an aging population, demand on the sector is only going to grow.

25 May 2023

Read more

Super Guarantee rate to increase on 1 July

If you’re an employee receiving the standard super guarantee (SG) rate, you can look forward to a super boost from 1 July 2023 when the SG rate increases from 10.5% to 11%.

25 May 2023

Read more

The many benefits of a sporting life

Taking part in regular sports or physical activity has incredible health and wellbeing benefits – and it can even extend your life for seven years or more.

08 May 2023

Read more

A Will isn’t always the only way

You would have heard the saying: “where there’s a will, there’s a way”. This statement is usually used to encourage people who are losing enthusiasm for a task or goal.

08 May 2023

Read more

Macro Perspectives: Recession, inflation, and duration consideration

Author: Stephen Dover, CFA Chief Market Strategist, Franklin Templeton Institute

08 May 2023

Read more

How to do a daily digital detox

Australians spend more time scrolling than sleeping. Here's how to take time to recharge yourself.

08 May 2023

Read more

What is the value of life insurance?

Life insurance can be valuable at various life stages, whether you’re young and single, starting a family or transitioning to retirement.

08 May 2023

Read more

Centrelink assistance for working age pensioners and incentives to downsize your home

There have been positive Centrelink changes to incentivise pensioners to increase their participation in the workforce (amid staff shortages) and to downsize from their family home.

08 May 2023

Read more

The power of positive thinking

Have you ever had a day, or even a moment, where it felt like everything had just fallen into place and you were completely content? Or have you managed to talk yourself up to get through something challenging or difficult?

09 June 2022

Read more

Your Super – Who to Nominate as Your Beneficiary?

Nominating your super beneficiary is something you have most likely been asked to do if you have a superannuation fund.

16 May 2022

Read more

Consider making a (larger) personal deductible contribution before 30 June

By making personal contributions to your super, you may be able to claim a tax deduction to reduce your tax liability which may allow you to pay less tax and invest more in super.

16 May 2022

Read more

March 2022 quarter economic review

On the inflation front, notably in the US, prices of durable goods were unchanged from January to February, while prices of non-durables were up 1.8%, largely due to rising energy prices.

16 May 2022

Read more

There’s an app for that

It seems we are increasingly using apps in everyday life. Apps can help us manage certain aspects of our lives, tap into things that are of interest to us, or keep track of different goals.

16 February 2022

Read more

Inflation: what does it mean for me and my money?

Inflation is a hot topic at the moment. But what exactly is it, and how does it affect you and your money?

16 February 2022

Read more

Economic Outlook: December 2021 Quarter Economic Review

Inflation continues to be the key topic in relation to the global economy. The U.S. consumer price index rose 0.5% for the month of December, 7.0% on a year-on-year basis, the fastest rate of increase since June 1982.

16 February 2022

Read more

Its our business to know your business

If you are a small business owner you would know the importance of having a good team behind you. That includes a team that can help look after your finances, talk to you about appropriate business insurance and discuss succession planning for when you decide to wind up the business, or you are forced out due to ill health or death.

18 November 2021

Read more

Financial tips that anyone can use

There are lots of tips when it comes to getting ahead, financial speaking. Most of them are really simple - if you’re struggling to get on top of your finances take a look at our suggestions and make a commitment to just start with one. If that works, maybe you will want to tackle a few more.

18 November 2021

Read more

Quarterly Economic Review - September

The COVID-19 pandemic remains a major feature on the global stage, although with growing vaccination rates and declining cases, the focus has shifted to China and inflation.

18 November 2021

Read more

Quarterly Economic Review - 30 June, 2021

The COVID-19 pandemic remains a major feature on the global stage, although global economic recovery continues, with the JP Morgan Markit Global Composite PMI remaining positive.

26 August 2021

Read more

Understanding changes to granny flat arrangements

On 1 July 2021, a new capital gains tax (CGT) exemption was introduced for certain granny flat arrangements, making it easier for older Australians to enter formal granny flat arrangements with the added protection from possible financial abuse if circumstances within the family change.

26 August 2021

Read more

Navigating your way through a redundancy

The Australian Bureau of Statistics announced a record 932,000 jobs were lost between the March and June 2020 quarters in the wake of COVID-19¹. If you are facing a possible redundancy at work due to the aftermath of COVID-19, or a company restructure, this is considered a significant life event that may impact your career, family, mental health and financial wellbeing.

26 August 2021

Read more

Economic Update: Looking ahead to 2022

If you can imagine the economy as a road, 2020 saw a major earthquake emerge with the Coronavirus pandemic, and the lockdown restrictions that followed to halt its spread, and the Government and RBA support helping to divert traffic around this major obstacle. 2021 will be a year of bouncing back and looking forward to the economic recovery, with rebuilding and a gradual resumption of normal activity. However, the world in many ways has now changed.

21 May 2021

Read more

Retirees’ Fears and Expectations

For many, the word ‘retirement’ is associated with the idea of extended holidays to far-flung locations or spending quality time with grandchildren. However, there are a range of financial, emotional and psychological fears that are often linked to retirement – and for good reason.

21 May 2021

Read more

How do you know when the advice is right?

Seeking financial advice can turn your life around and put you on a path to a happier and more secure financial future. But where do you start? Who do you trust? How do you know you are going to get value for money?

21 May 2021

Read more

Can social media affect our spending?

Social media could influence us to spend impulsively. Can social media use be linked to spending? Research shows it can. For example, one study found that social networks such as Facebook and Instagram can motivate impulsive buying behaviours.1 But how does social media affect our spending?

21 May 2021

Read more

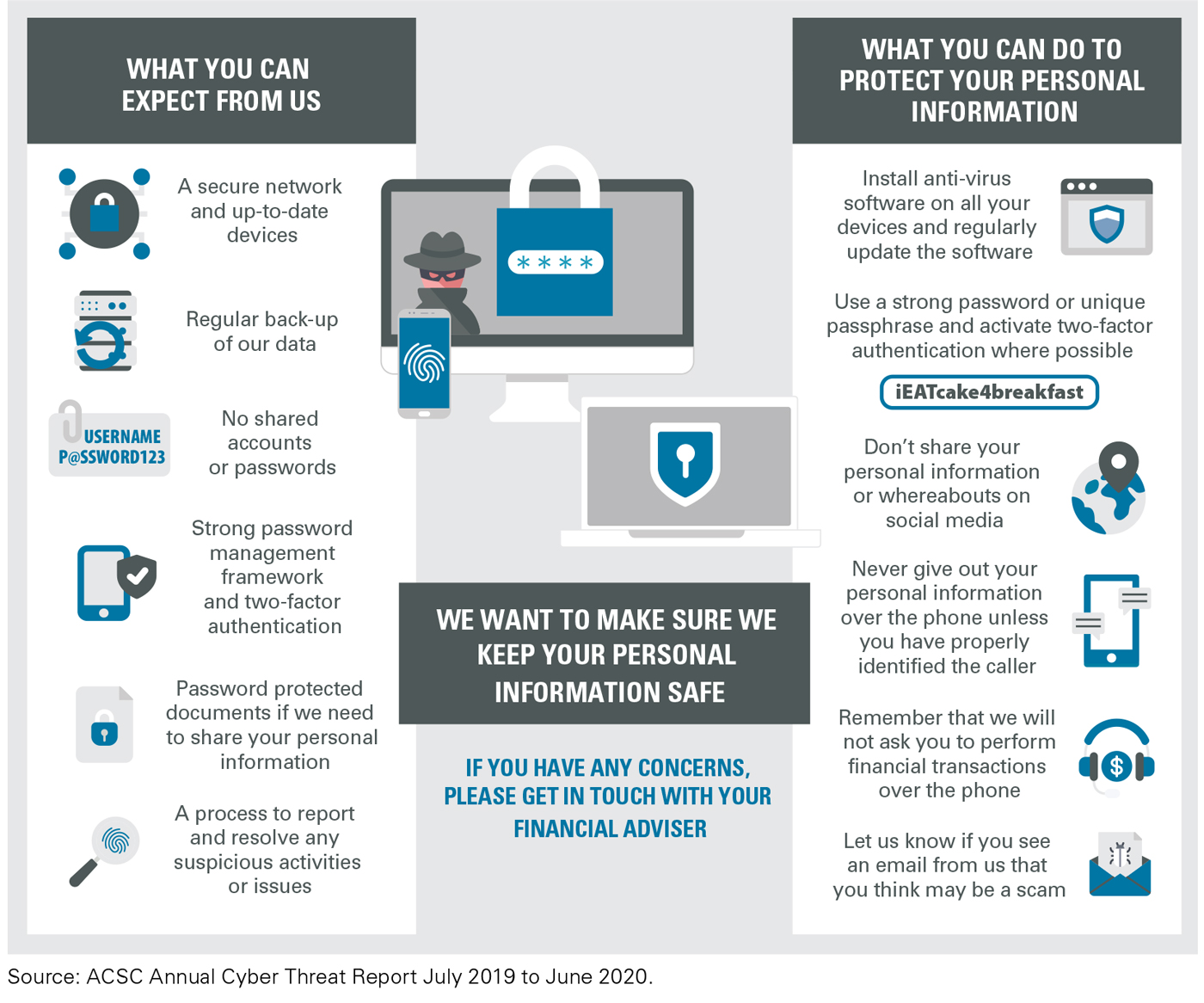

Cyber security

According to the Australian Cyber Security Centre, Australians lost over $634 million to scams in 2019.

24 February 2021

Read more

Three trends driving real estate investments in a post-pandemic economy

Office real estate is undergoing a fundamental shift, while COVID-19 has accelerated a number of global real estate investment trends, including the continued growth of e-commerce and falling home ownership.

24 February 2021

Read more

Do you need to review your insurance?

Since December 2020 the world has embarked upon a mass effort to vaccinate against the Coronavirus pandemic. The leading solutions have been produced by joint ventures led by Pfizer, Moderna and AstraZeneca respectively. Israel and the UAE are amongst the leaders on a per-person basis and are beginning to see a decline in the severity severity and mortality rates amongst its elderly citizens.

24 February 2021

Read more

Economic Update

Since December 2020 the world has embarked upon a mass effort to vaccinate against the Coronavirus pandemic. The leading solutions have been produced by joint ventures led by Pfizer, Moderna and AstraZeneca respectively. Israel and the UAE are amongst the leaders on a per-person basis and are beginning to see a decline in the severity severity and mortality rates amongst its elderly citizens.

24 February 2021

Read more

Economic outlook: looking ahead to 2021

How we get past the Coronavirus pandemic will be a defining moment of 2021. The direction of the United States under its new President, Joe Biden*, will also be watching closely around the world.

16 November 2020

Read more

Which are you – a saver or investor?

Whether you are a saver or investor could make a major difference to your lifestyle in the long run.

16 November 2020

Read more

Transitioning to retirement

If you have reached preservation age, currently 58, the Australian Government has made it possible for you to access your super as a non-commutable income stream while you are still working.

16 November 2020

Read more

How to seek out positivity and improve your wellbeing

In April 2020, online searches for “good news” spiked to a five year high.1 Amid all the uncertainty in the world right now, people are actively searching for uplifting stories to act as a counterbalance to all the negative news we’re hearing.

16 November 2020

Read more

Self-employed? Don’t leave your business at risk.

What would you do if you became sick or injured and were unable to keep your business running? It’s not something that is often thought about, but it is important to take a moment to consider it.

13 August 2020

Read more

Make technology work for you

Are you a new technology pioneer, or a proud ‘technophobe’? Wherever you sit on the digital spectrum, the transformative power of technology is undeniable. What’s important is how you harness it.

13 August 2020

Read more

Top tips when preparing your Will

Preparing a Will can be complicated, especially if you have a complex family structure. Here are some tips to consider when writing a Will

13 August 2020

Read more

How did interest rates get so low?

We are operating in a world where interest rates are now very low both overseas and here in Australia.

13 August 2020

Read more

Economic Update

The spread of Coronavirus (COVID-19) has been one of the most devastating global pandemics we have seen for decades with over 4.3 million confirmed cases and almost 300,000 deaths globally (as of mid-May).

25 May 2020

Read more

Taking control of your finances post-divorce

There’s no doubt a divorce takes a toll emotionally. However, there are also financial implications that can leave you feeling vulnerable, especially if you’re retired or approaching retirement.

25 May 2020

Read more

The electric car revolution

Previously occupying a niche luxury market dominated by Nissan and Tesla, EVs are growing in popularity and are set to become more mainstream with manufacturers such as Hyundai, Kia and Mini looking to release more affordable options in the future.

25 May 2020

Read more

The real value of financial advice

The real value of financial advice Financial advice is NOT all about money, it’s a big part of it of course, but there’s so much more to it than that. It’s about having an expert guide to help you reach your goals sooner – giving you more confidence, peace of mind and freedom.

25 May 2020

Read more

The Federal Government’s second stimulus package announced

The Federal Government has announced several stimulus measures designed to counteract the economic impact of Coronavirus. Parliament is currently sitting to legislate these measures but we expect them to pass largely unaltered.

25 March 2020

Read more

Economic Update

Markets fall on oil price and coronavirus shocks

12 March 2020

Read more

Retirement income worry - who worries and why?

Two-thirds of retirees who have been retired five years expect to spend their savings over the next 20 years.

10 March 2020

Read more

5 investing questions everyone should ask (and answer)

The thought of investing can be daunting to some. To help, we’ve compiled a series of questions every investor should ask themselves and be able to answer.

10 March 2020

Read more

Are you still covered by Insurance inside super?

Insurance inside super or ‘Group Insurance’ is the life insurance cover you may have through your employer or your superfund.

10 March 2020

Read more

Gross Domestic Product (GDP) – What does it mean?

What does Gross Domestic Product (GDP) mean? Well, it depends who you ask. If you ask the renowned artist Banksy, it is a means by which trademarks can be registered.

28 November 2019

Read more

Be conscious of how you invest in equities during the ‘retirement risk zone’

In the years just before and after your retirement is a period known as the retirement risk zone. It’s a decade when your nest egg is likely to be its highest.

28 November 2019

Read more

Two common errors investors make…and how to overcome them

Understanding compounding and portfolio rebalancing could have helped investors overcome emotion-driven decisions during a turbulent six months for stock markets. Duncan Lamont shares why.

28 November 2019

Read more

Economic update

Global economy The trade war between the United States (US) and China, fixed income and currencies, the impact of the Reserve Bank of Australia's rate cuts.

28 November 2019

Read more

How social media is affecting your spending

Social media use has been linked to our mood, self-esteem and even sleep. Research shows that it can also be linked to our spending.

17 September 2019

Read more

Get insurance while you’re still bulletproof

According to research by TAL insurance, the cost of personal insurance soars after the age of 35. This is also the time in our lives that you may be going through significant change such as marriage, children, a bigger mortgage and more responsibilities.

17 September 2019

Read more

Economic Update

In the US there are signs of slow economic growth this year. This is apparent from some leading indicators, such as the Markit Purchasing Managers’ Index (PMI) and, to an extent, official economic data. Slow economic growth is a global theme, with few exceptions. The Australian economy is not immune to this slowdown.

17 September 2019

Read more

What changes to the social security means test rules for lifetime income streams could mean for you

In February of this year the Government passed new law that changes the means testing rules for certain lifetime retirement income streams (super and non-super lifetime pensions and annuities). This commenced from 1 July 2019.

17 September 2019

Read more

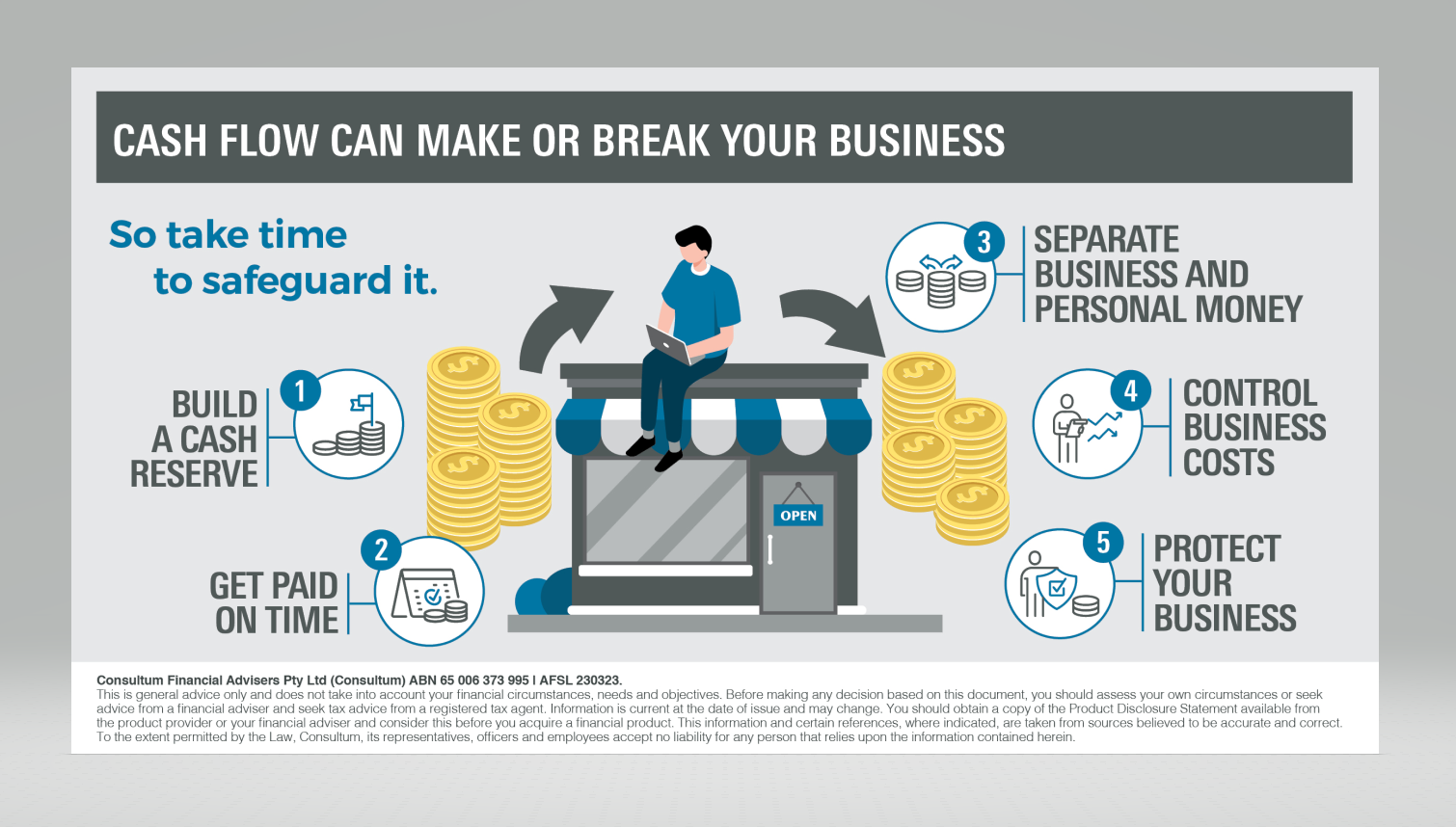

Cash flow can make or break your business, so take time to safeguard it

So what might you do to improve your cash flow and sleep better at night? Here are five tips.

01 August 2019

Read more

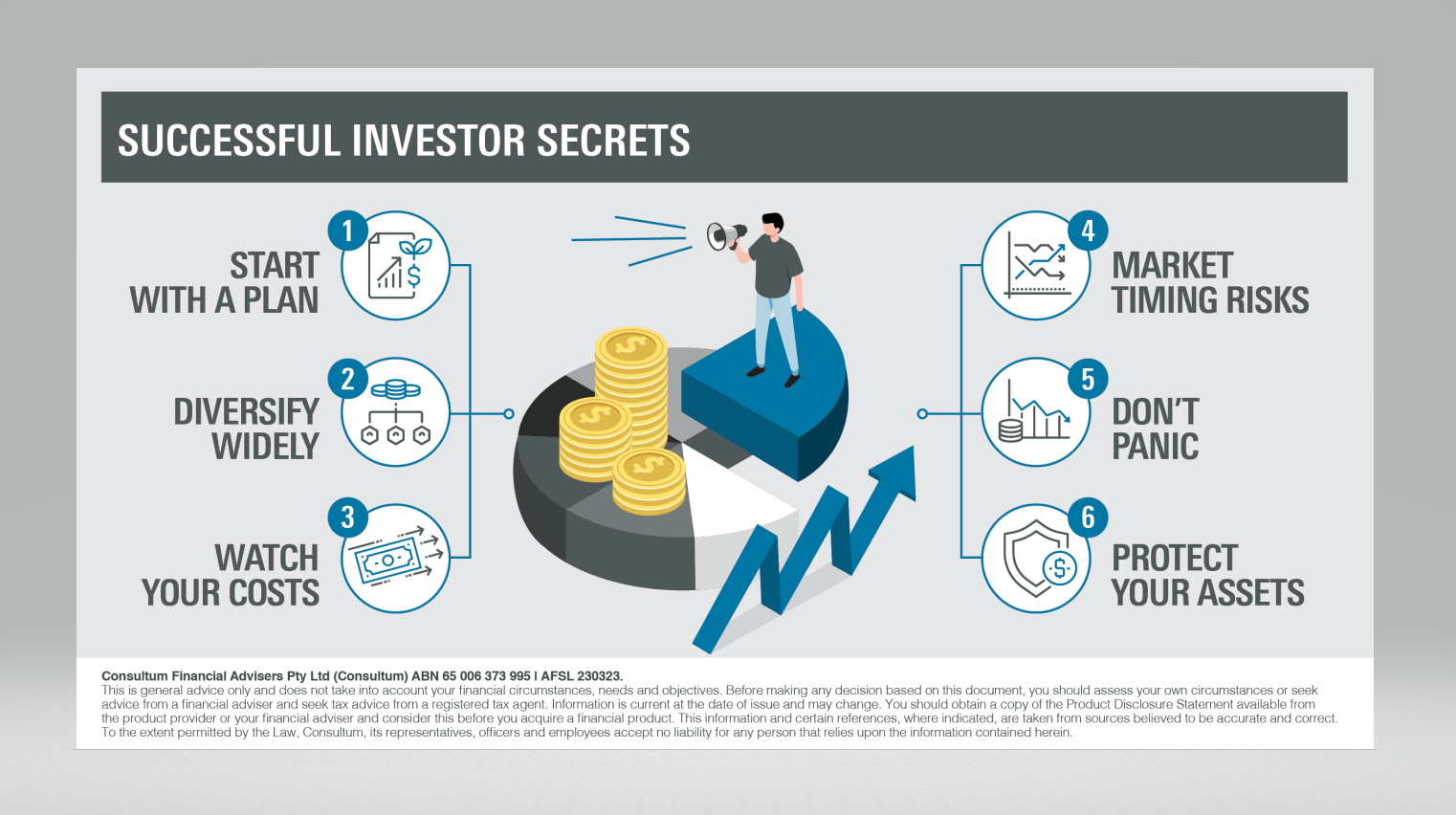

Successful Investor Secrets

The investment world can change dramatically from one month to the next. But these secrets of successful investors never go out of style.

01 August 2019

Read more

A wonderful testimonial

A wonderful testimonial from one of Australia's preeminent Global Fund Managers, Hamish Douglass, from Magellan Financial Group. Hamish has ran the Magellan Global fund for over twelve years and Rba Financial Group and our clients have been supporters from the very start.

28 May 2019

Read more

Economic Outlook

Overall, we are likely to see a slowdown in growth for both the Australian and global economies over the next year. Upcoming elections, including our own Federal election, will have a major influence on the economy as will government spending.

24 May 2019

Read more

Tax tips and tax return hints

As we come close to the end of June, here are some initial tips and hints to help you get started.

22 May 2019

Read more

Heart health by numbers

Some risks for cardiovascular disease can’t be changed, such as age and family history, but many are lifestyle-related, which is good news – you have the power to reduce your risk(1). This is vital given that heart disease is the single biggest killer of Australians(2). Maintaining a healthy weight, exercising regularly and eating well are some of the best ways to prevent heart disease. Keep the following numbers in mind.

22 May 2019

Read more

2019 Federal Budget announcement

This year’s Federal Budget is an ‘election budget’ with future tax cuts for all Australians, especially low and middle income earners. Overall, there were minimal changes to super proposed in the Budget, with minor changes to super contributions for older Australians.

03 April 2019

Read more

7 technology disruptions happening now: Autumn 2019

Australia looks to be in the later stages of the business cycle, and is not alone here among its developed economy peers. In an environment of potentially slowing growth, we propose that a way forward is to invest in companies which are “share-takers” – companies that can gain market share from technology-enabled advances in their business model, and in changes in consumer behaviour.

22 March 2019

Read more

Bullet-proofing your equity income portfolio

It’s obvious, if you’re a retiree you need income. With cash and fixed interest offering low yields, equities are a good place to look for income.

22 March 2019

Read more

3 ways a financial adviser can help you plan for retirement

When it comes to creating the retirement lifestyle you dream of, a little support goes a long way.

22 March 2019

Read more

Economic update: Autumn 2019

In this issue 1. Economic update 2. 3 ways a financial adviser can help you plan retirement 3. Bullet-proofing your income equity portfolio 4. 7 technology disruptions

22 March 2019

Read more

All I want for Christmas… is to survive it debt free!

Getting into the Christmas spirit doesn’t mean you have to get into debt

01 December 2016

Read more

Keys to de-stressing a mortgage

Don't sail out farther than you can row back.

01 December 2016

Read more

Retirement is different

The four stages to a better retirement

01 December 2016

Read more

Boosting inflation – Central banks struggle

The Reserve Bank of Australia (RBA) reduced the official cash rate by 25 basis points to 1.50 per cent in the September quarter.

01 December 2016

Read more

The Great Rotation

After almost a decade of underemployment, low rates and sub-optimal growth across the globe, it appears as if investors have formed the view that Trumpenomics will be the dawn of a new era.

22 November 2016

Read more

Testimonials

Customer satisfaction is our primary goal.

06 October 2016

Read more

Estate planning triggers

Although it includes the preparation of a valid Will, effective estate planning goes far beyond one single document.

08 September 2016

Read more

How to avoid investment behavioural traps

Many people don’t realise the greatest impact on their investment returns could in fact be their own behaviour.

08 September 2016

Read more

Getting financially prepared to start a family

Having a baby is a wonderful experience, but are you financially ready for it?

07 September 2016

Read more

Federal Budget Q&A – Lifetime non-concessional contributions cap

One of the proposed changes announced in the May Federal Budget was to replace the annual cap for concessional contributions with a lifetime cap of $500,000.

07 September 2016

Read more

The secrets to a healthy work/life balance

Work life balance means different things to different people and for many of us it no longer means working nine to five.

07 September 2016

Read more

Trauma insurance fills the gaps

Heart disease and stroke continue to be the two most common causes of death in Australia for people over the age of 45, and accounted for over 30,000 Australian fatalities in 2012.

07 September 2016

Read more